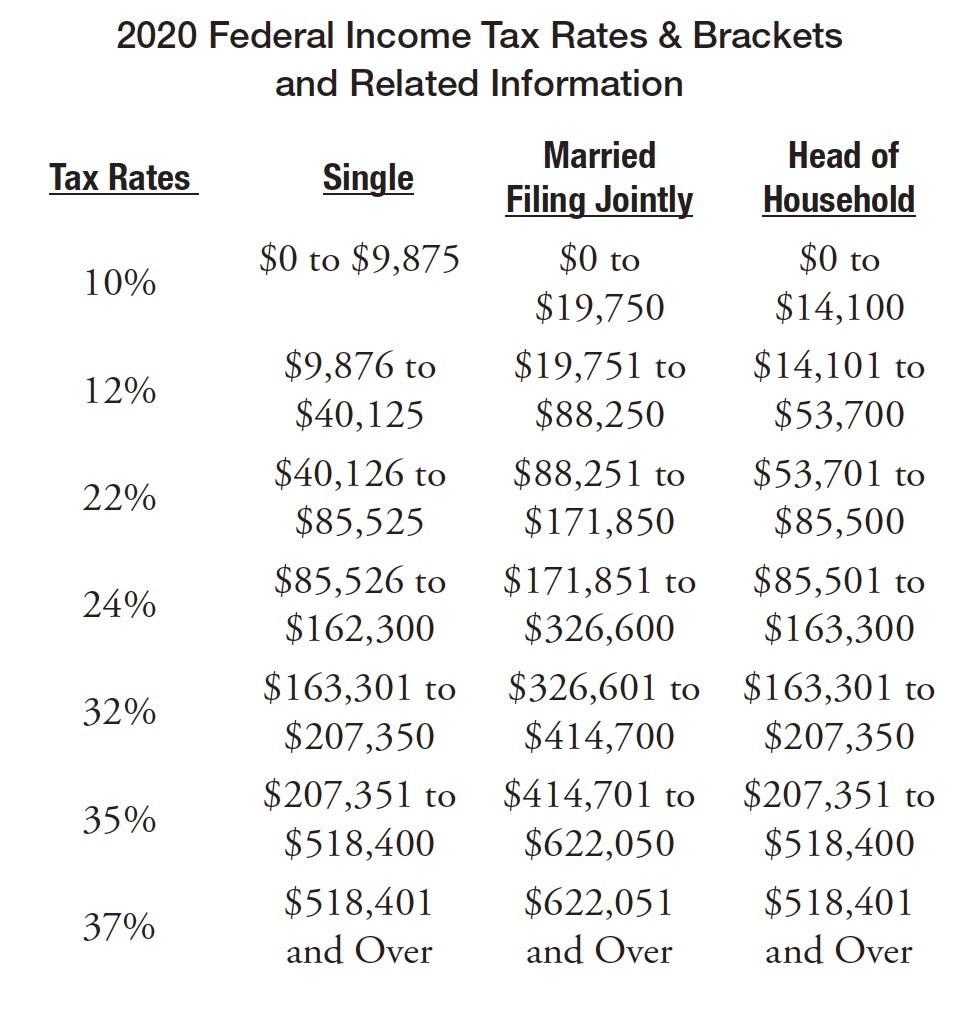

federal income tax rate 2020

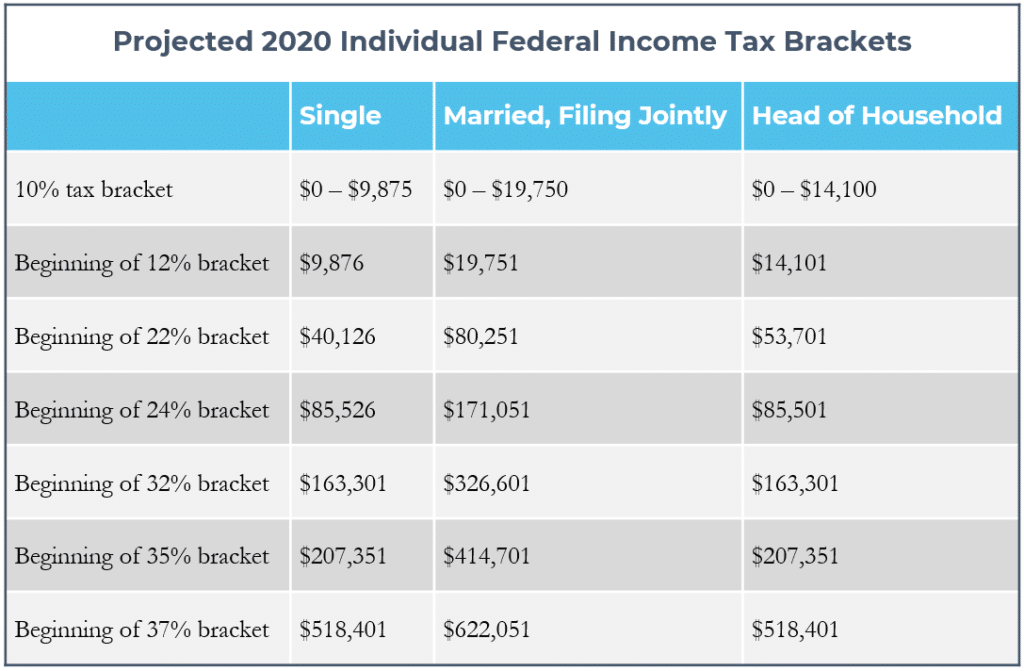

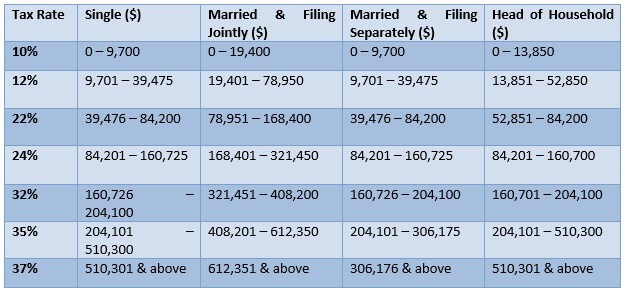

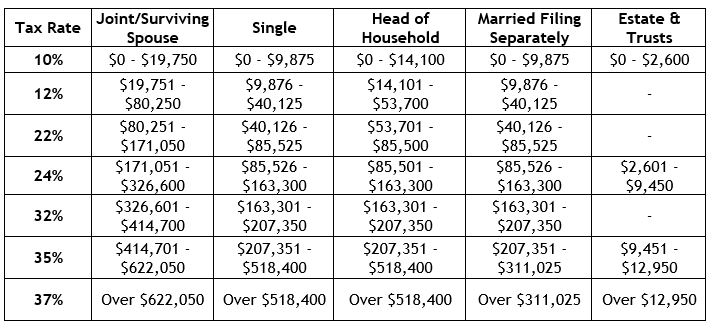

Federal Income Tax Rates for 2020. Updated with tax rates for tax year 2020 due April 2021 Single Married Jointly Married Separately Head of Household Marginal Tax Rate.

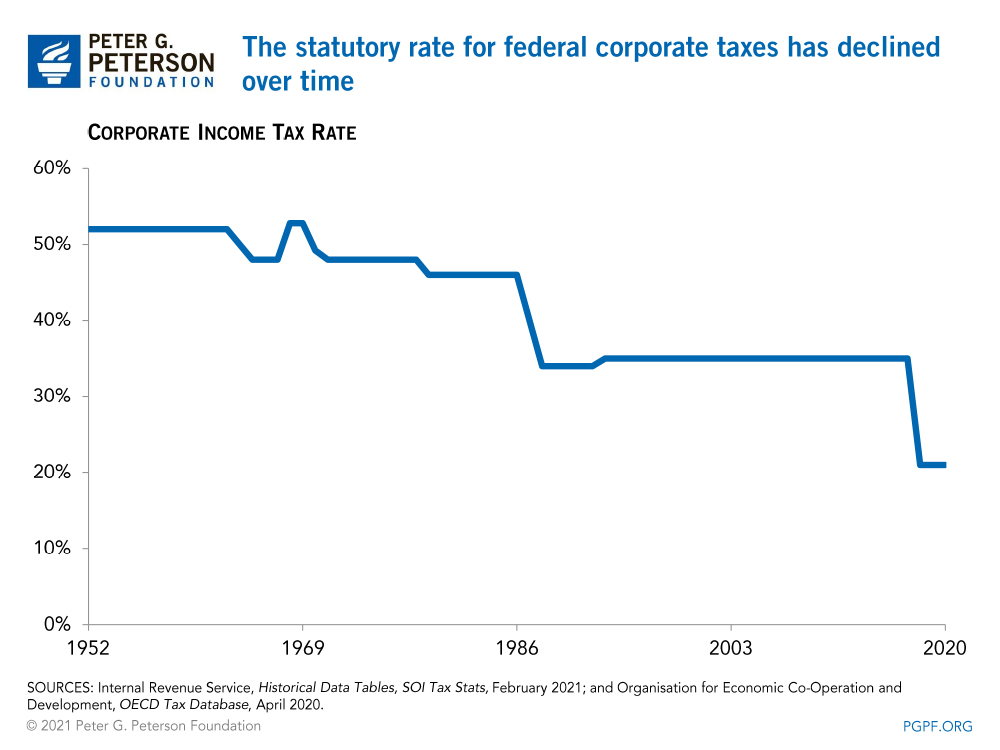

The U S Corporate Tax System Explained

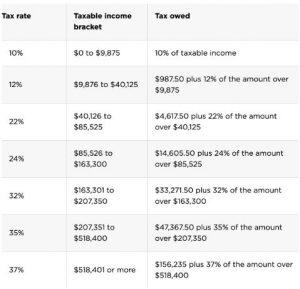

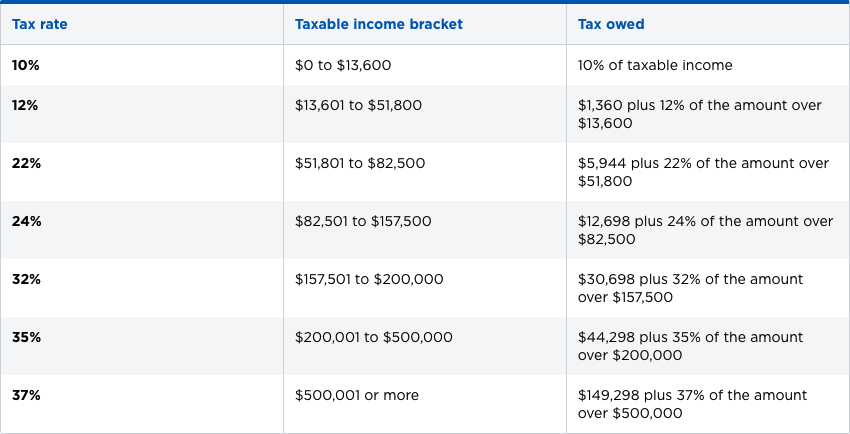

Your income is taxed at a fixed rate for all income within certain brackets.

. For 2018 and previous tax years you can find the federal. 2020 Simple Federal Tax Calculator. Federal income tax rates increase as taxable income increases.

You can use the Tax Withholding. Taxes paid rose to 16 trillion for all taxpayers in. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

The following tables list the 2020 federal marginal tax rates along with the 2019 rates for comparison. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and. The income ranges for each bracket will be indexed for inflation going forward and the reduced income tax rate brackets will sunset after 2025.

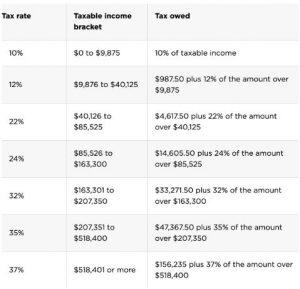

Tax rates for previous years 1985 to 2021. 2020 Federal Income Tax Rate Schedules Individuals Trusts and Estates Single taxpayers. As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on.

For help with your withholding you may use the Tax Withholding Estimator. If taxable income is. To find income tax rates for previous years see the Income Tax Package for that year.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Single 2019 2020 Marginal Tax Rate Taxable Income Marginal Tax Rate Taxabl. Based upon IRS Sole Proprietor data as of 2020 tax.

Federal Income Tax Rate 2022 - 2023. The information you give your employer on Form W4. 10 of taxable income.

2021 Federal Income Tax Rates - Tax Year 2020. Your tax bracket is the rate that is applied to your top slice of income. There were 24 million more tax returns filed in 2017 than in 2016 and average AGI rose by 4232 per return or 58 percent.

Over 9875 to 40125. How to calculate Federal Tax based on your Annual Income. Americas 1 tax preparation provider.

Effective tax rate 172. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24. Quickly Estimate 2020 Income Taxes Income Tax Refunds for 2021.

Enter your filing status income deductions and credits and we will estimate your.

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Key Numbers Federal Income Tax Rate Schedules Individuals Trusts And Estates Dightman Capital

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Summary Of The Latest Federal Income Tax Data Tax Foundation

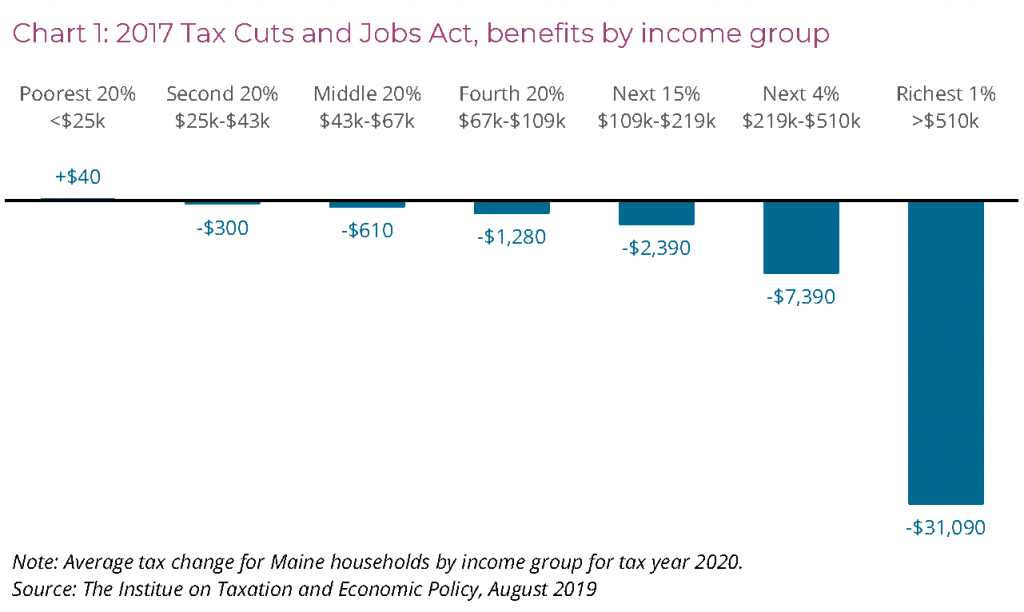

Two Years Later Trump Tax Cuts Are A Proven Failure Mecep

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Most Working Americans Don T Pay Federal Income Taxes A Problem

The Difference Between Marginal Tax Rates And Effective Tax Rates Federal Retirement Services

Year End Tax Planning Moves For Small Businesses Grf Cpas Advisors

Summary Of The Latest Federal Income Tax Data Tax Foundation

Corporate Tax In The United States Wikipedia

Federal Income Tax Brackets Brilliant Tax

Marginal Tax Rates On Labor Income In The U S After The 2017 Tax Law

Who Pays Income Taxes Foundation National Taxpayers Union

United States How Does The Us Federal Income Tax System Work Personal Finance Money Stack Exchange

Federal Income Tax Definition Rates Bracket Calculation

2020 Year End Tax Planning Highlights For Individuals Dalby Wendland Co P C